London, United Kingdom shopping tax refund – Wevat review

I am sure you have heard of complex instructions from your friends about the UK tax refund process. Long receipts to fill in, high administrative charges and with so many tax refund companies to choose from, where do you start? Well, You’ve come to the right place! Let me fill you in on the United Kingdom shopping tax refund and Wevat review.

Introducing Wevat – A new UK Tax Refund Start-up

According to their website, it promotes a higher tax refund return compared to other more well-known companies such as Global Blue and Premier Tax Refund. All it takes is to download the app and upload shopping receipts into the app. The app consolidates all of the tax refunds and generates a single form for custom verification. Once verified, the tax refunds could be tracked directly from the app. No more guessing on when will the money be credited!

It was in Bicester Village where I found myself overwhelmed and lost on the tax refund process. I began searching for informationon Google and came across Wevat.

Initially, I was skeptical. Wevat is a relatively new start-up and is almost unheard of. I tried to search on the company for more information but could not find any reviews or bloggers sharing their experience with them.

Now in retrospect, I am glad we decided to go with Wevat. They changed my perpecvtive on the UK tax refund process with their great customer service and lower administrative charges. I will definately recommend every UK tourist to use them.

How to use Wevat – Step by Step

Wevat is only available for iOS users. Sorry Android folks, I am sure it will come soon. iOS users can click on this link to start the download and get £5 off administrative charge.

Once downloaded, you will be tasked to sign up for an account. You could use Wechat or Facebook if you like to sync your social media accounts with it or select “Use email instead” at the bottom.

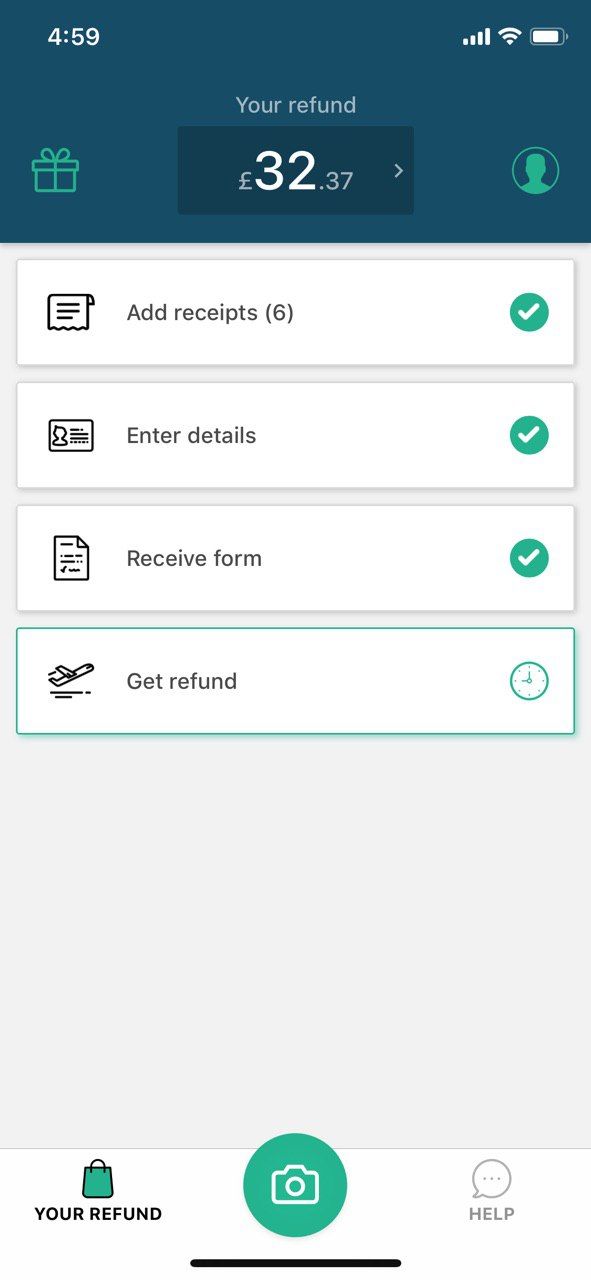

This is what I like about Wevat, the clean interface directs you step by step in filing for your tax refund. After keying in your deparature and return date, you will be directed to the main screen where 4 clear and simple steps are presented to you.

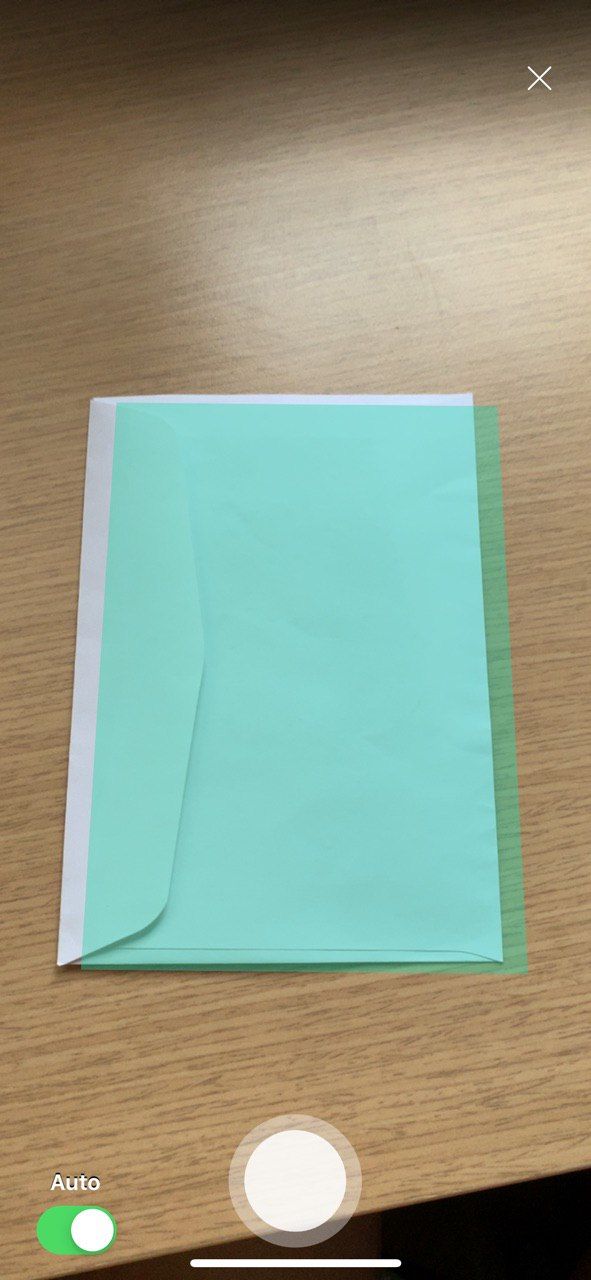

Start the process by taking photos of your receipts simply by clicking on the camera button at the bottom. I am impressed by the ‘Auto’ feature as it tries to find your receipt and crop the image to it. After confirming the crop, you are then able to add multiple receipts, if you have. Each receipts will be recorded individually.

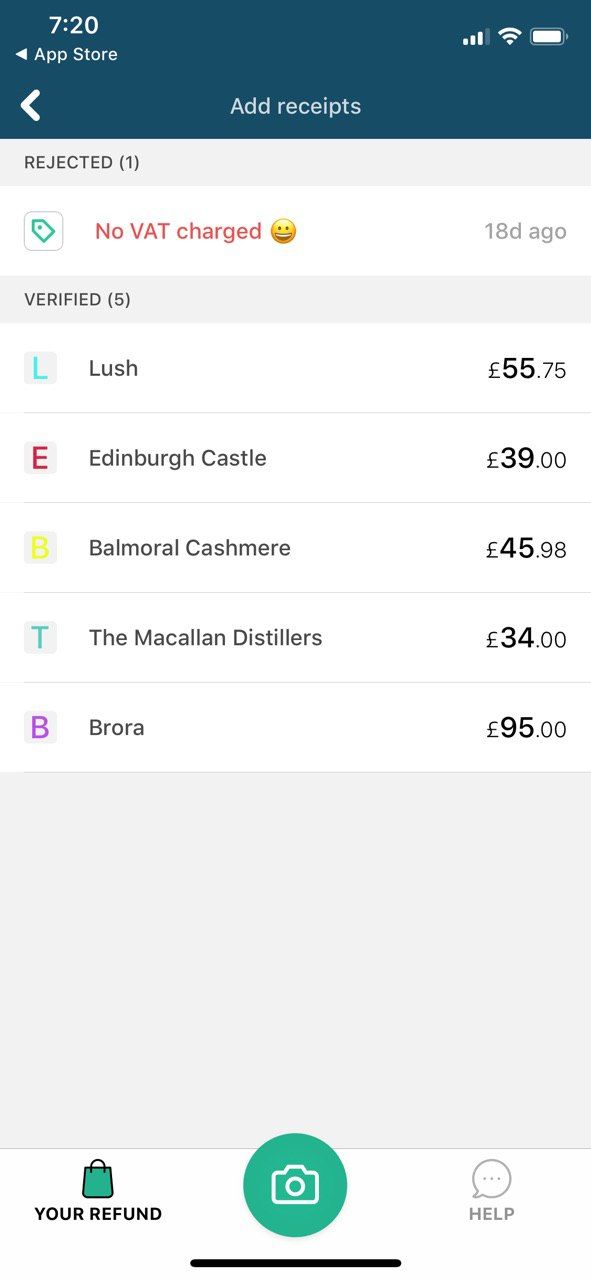

After submitting the receipt to the app, it will trigger a 2 – 4 hours verification period. This is to prevent fraud and invalid refunds, so be patient about it. Important note: Do not leave the tax refund process until the last day of your trip. Start adding the receipt immediately once you exit the store with your shoppings.

The next step is to enter basic personal information such as name, passport number and home address. The app will prompt you for refund option. Currently, only bank transfer is available but I was told by Wevat that they are working on credit card refunds.

After scanning and getting verification for all of your receipts, the actual amount refund is displayed right at the top of the app. Clicking on it, gives a transparent view of the admin charges and the actual refund you will be recieving.

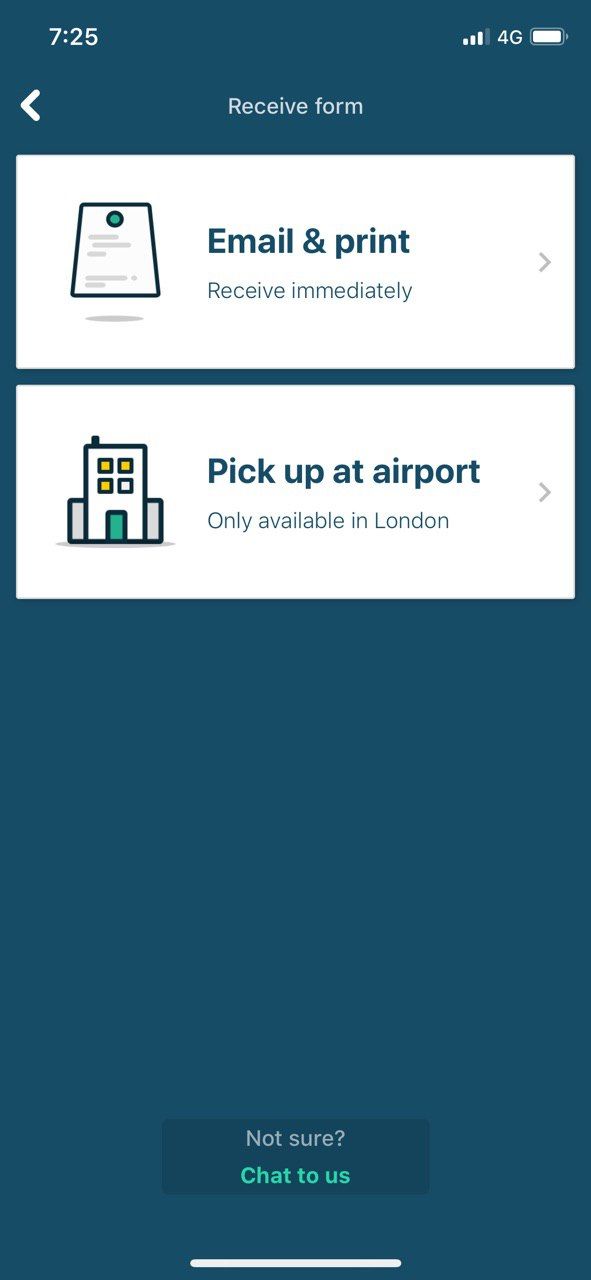

The next step is to get a physical copy of the tax refund form. As I was staying in a service apartment, I was able to get the form printed with the help from the apartment staff. If you are unable to find a printer, Wevat offers another option to get the printed form right at the airport.

The tax refund form includes all necessary information which make the process easy and efficient. You would only need to sign on the form and verify that all the details are printed correctly.

Now you are ready to head to Heathrow Airport’s custom office to get the tax refund form signed! Here is the link of where the VAT refund custom office is located in Heathrow Airport.

At the customs counter, present the tax refund form and the staff would stamp the custom inspection seal after inspecting your items. At this point, request to take a photo of your form with the seal. This would help to serve as a record for future references. The staff will then proceed to send the stamped tax refund form to Wevat for processing.

Once Wevat has received the stamped form, you will then receive an email stating that Wevat is initiating a bank transfer from TransferWise. After filling up the necessary details, the refund will be credited to your stated bank within a day or two. I actually got my refund within 3 weeks from my departure date! This was so much efficient as compared to the 6 months timeline stated by the bigger VAT refund companies.

Tips for UK tax refund – Wevat

Tip #1 – When purchasing your items at the check-out counter, the staff will ask if you want to do a tax refund. Reject them. If you did not, the counter staff would stamp the receipt , indicating tax refund has been issued. Wevat will not be able to process such receipts.

Tip #2 – Check your receipts! If you are charged with VAT, you can add the receipt for tax refund. But of couse, dining receipts are not eligible.

Tip #3 – Do your filing early! Reach the airport early! I recommend to reach Heathrow Airport at least 6 hours before your departure. Expect long queues at the VAT customs office.

Tip #4 – Wevat comes with an in-app chat application. This feature is very much welcomed for any tourist who does not have a local SIM card to make a call. Connecting to any Wi-Fi or a data SIM card allows you to communicate to Wevat customer service.

Tip #5 – Get $5 off your administrative charges by using this link to download Wevat.