Are you a tourist figuring how to claim the tax refund on your Korea shopping loot? You might have realized by now that it isn’t a straight forward process. Having 6 (yes, SIX) tax refund companies means that you might have to visit up to 6 different booths to make your claims. Fret not! We’re here to shed light on the Korea tourist tax refund process to save you some bucks!

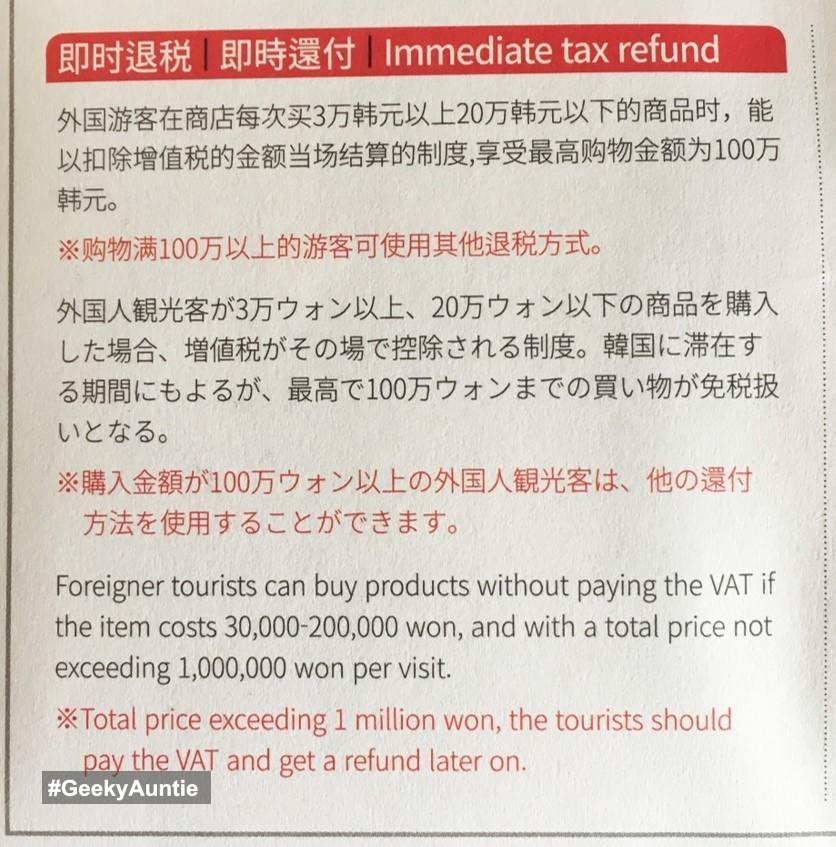

Immediate Tourist Tax Rebate at Selected Stores

Thanks to a new initiative implemented in January 2016, you’ll find Immediate Tax Refund provided by some of our favourite beauty stores like Nature Republic, Missha and foodies’ supermart – LOTTE! How sweet is that? Just flash your passport to the cashier (so bring along your passport when you shop) and keep your bill between KRW 30,000 and KRW 200,000 to qualify. Amounts exceeding KRW 200,000 would have to go through the 3-step Downtown or Airport Cash Refund process.

Tip: Ensure your loot exceeds KRW 30,000 after discount and excluding tax-free items!

Many stores offer massive discounts and the sales staff might not do the maths for you. Be sure that your loot exceeds KRW 30,000 after discount! Here’s another catch. While shopping at Lotte, we found out that some items were already tax-free so they did not add into our total sum for tax rebate purposes i.e. our supposedly KRW 61,000 receipt did not qualify for the second tier that cuts off at KRW 60,000, which means lesser cashback for us. Sad.

How many % do I get back from the tax refund?

KT Tourist Rewards provides a tax refund calculator online. While the VAT is around 10%, the tourist tax refund is a tier system. Shops that offer immediate tax refund usually have a chart at their cashier counter, so do check that out before you make your final purchase. Based on my experience, the sales staff don’t help tourists maximize their tax refund, so you’re on your own. And it might at times be more worthwhile topping up your loot to the next tier.

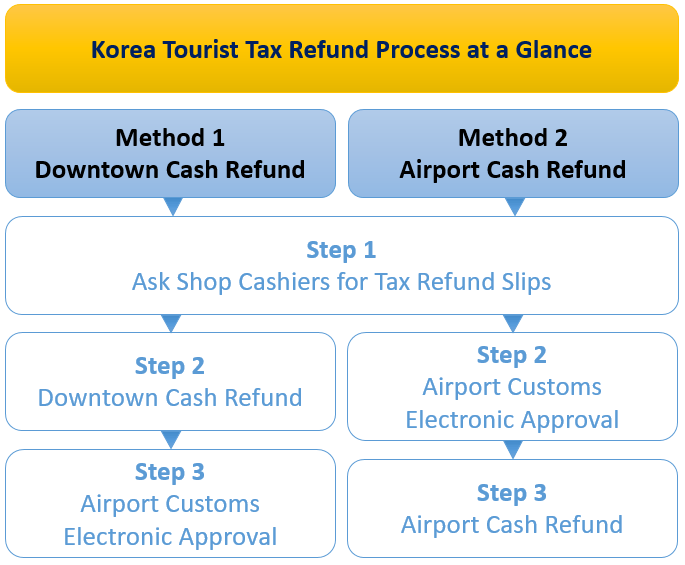

Overview of Korea Tourist Tax Refund Process

Should I choose Downtown Cash Refund or Airport Cash Refund?

Reality has it that most stores still require tourists to make separate claims via 1) Downtown cash refund or 2) Airport cash refund. What’re the pros? Downtown cash refund saves you time at the airport, so you won’t have to make a difficult choice between ‘skipping your tax refund’ and ‘running late for your flight’. It’s also a good idea if you have a late night flight, as the airport tax refund counters might have closed. However, if you have plenty of time ahead of your flight, you can consider going for Airport cash refund as a one-stop option.

Method 1: Korea Downtown Tourist Cash Refund Procedure

Let’s start off with the Downtown claim method.

Step 1. Ask Shop Cashiers for Tax Refund Slips

Ask for a tax refund slip at the cashier and you’ll be given one usual receipt and a tax refund slip in an envelope. The envelope specifies which company to claim from. E.g. Style Nanda uses Global Tax Free. A minimum spending of KRW 30,000 in a single receipt qualifies for tourist tax refund.

Do I need to fill in my personal details on the receipts and tax refund envelopes?

Times have changed. A tax refund counter lady advised that it is no longer necessary.

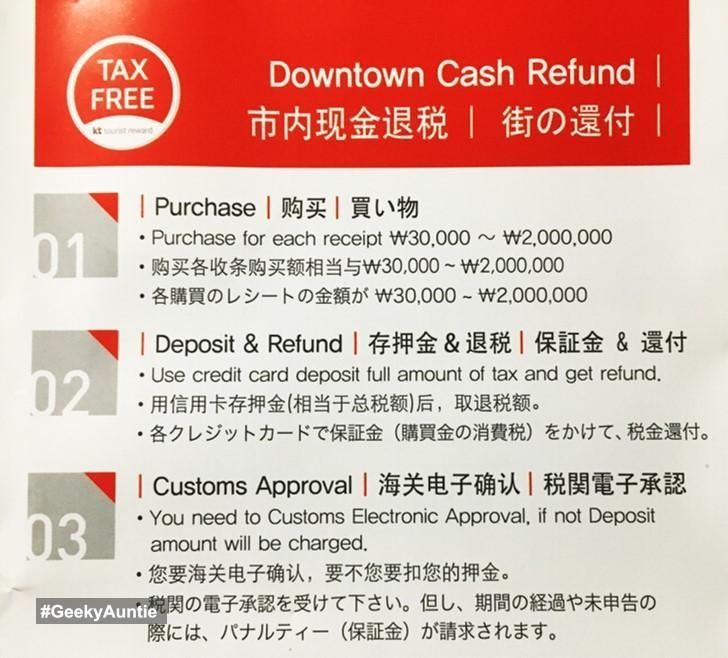

Step 2. Downtown Cash Refund

As mentioned earlier, having 6 tax refund companies mean that you would potentially have to visit up to 6 different downtown tax refund booths to get your cash, yes they give you cash. Yayyyy! Extra cash for more shopping!

A list of downtown tax refund booth locations is provided at the bottom of the Official Site of Korea Tourism site.

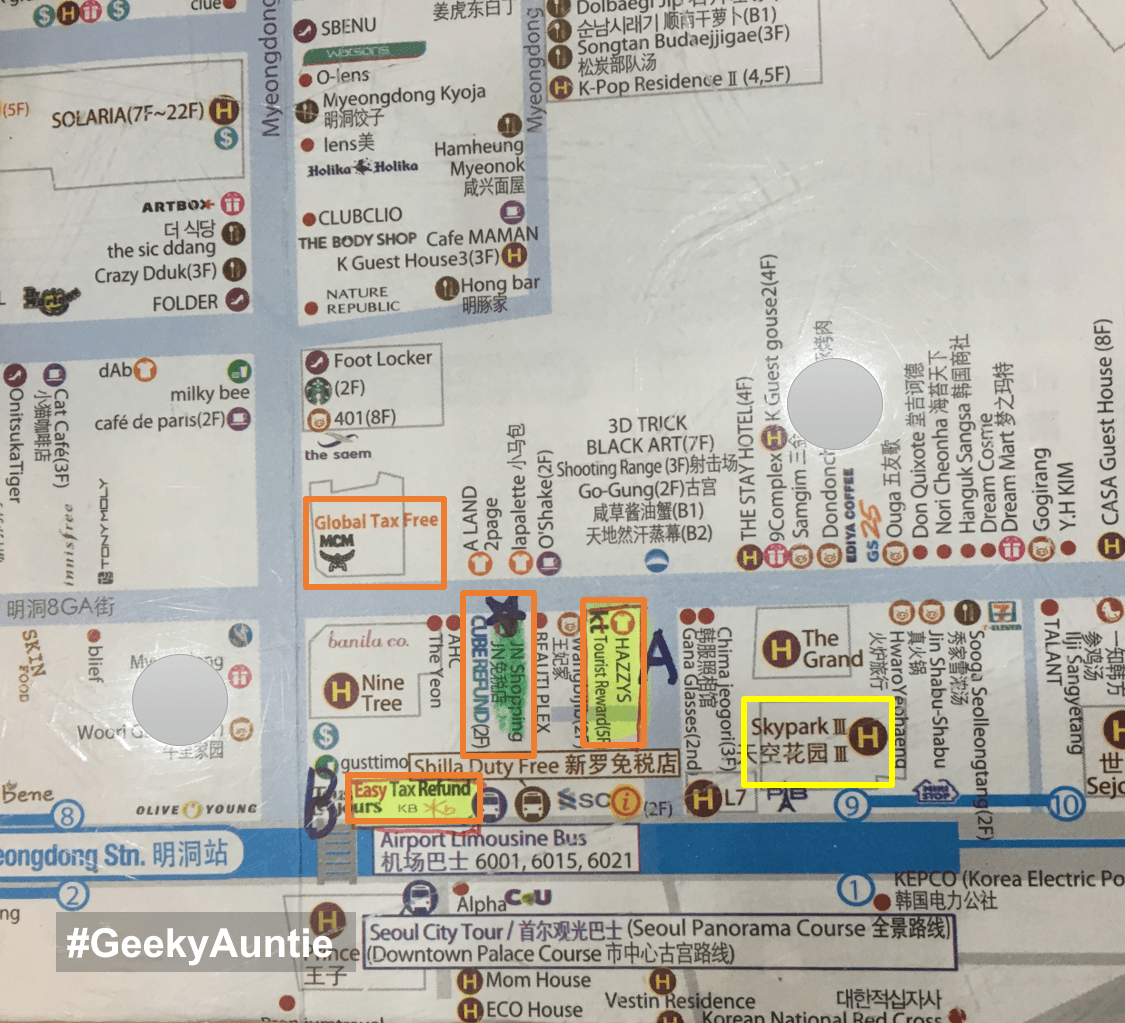

But if you’re shopping at MyeongDong, here’s a map of 4 of the Downtown cash refund booths (Global Tax Free, CubeREFUND, KT Tourist Rewards & Easy Tax Refund) within walking distance.

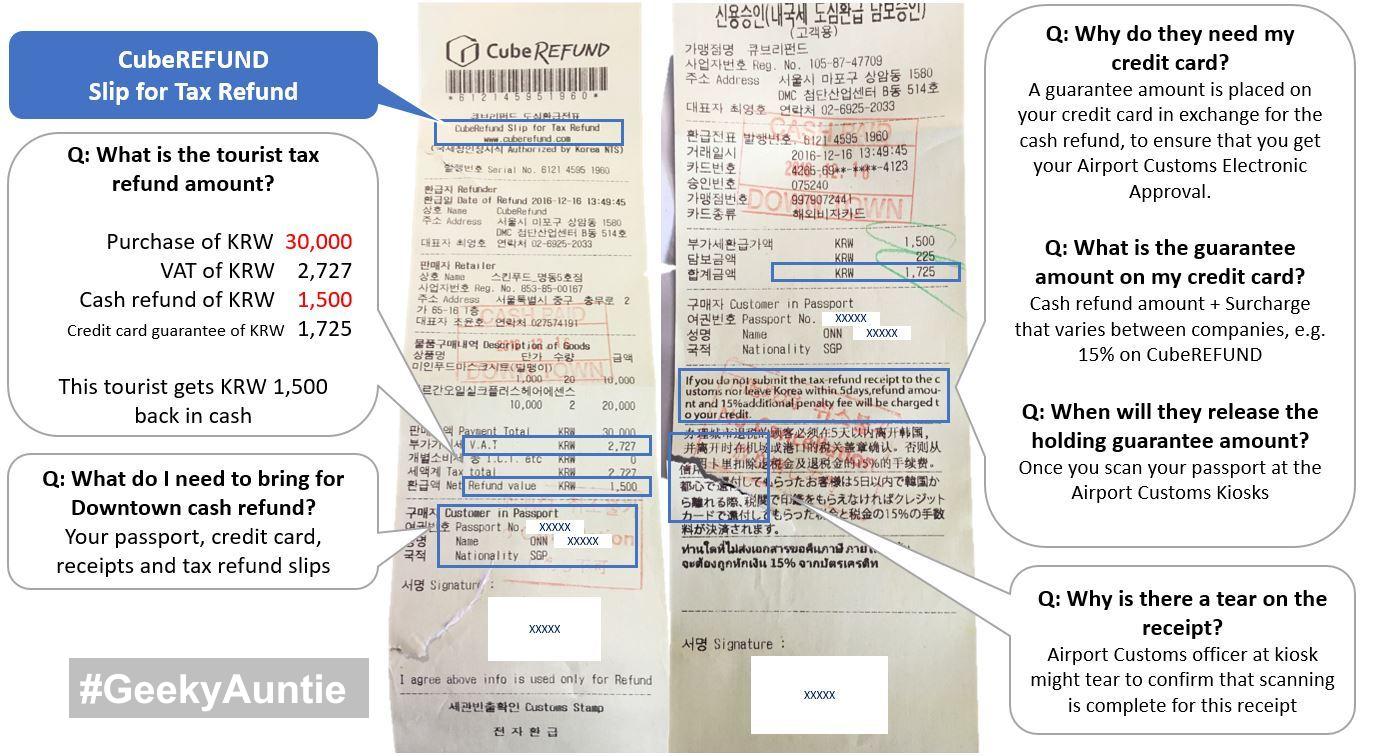

In exchange for the cash refund, a guarantee/deposit is temporarily charged to your credit card. This amount comprises of ‘cash refund + a surcharge that varies between companies’ e.g. CubeREFUND places a 15% surcharge.

What do I need to bring for a Downtown cash refund?

Passport, credit card, receipts and tax refund slips.

Do I need to bring my shopping products to the Downtown cash refund booths?

There is no need to bring your shopping loot.

When will they release the guarantee/deposit amount from my credit card?

Once you scan your passport at the Airport Customs kiosk for Customs Electronic Approval.

Tip: Check the operating hours of the Downtown cash refund booths you’re visiting. You wouldn’t want to make a wasted trip, do you?

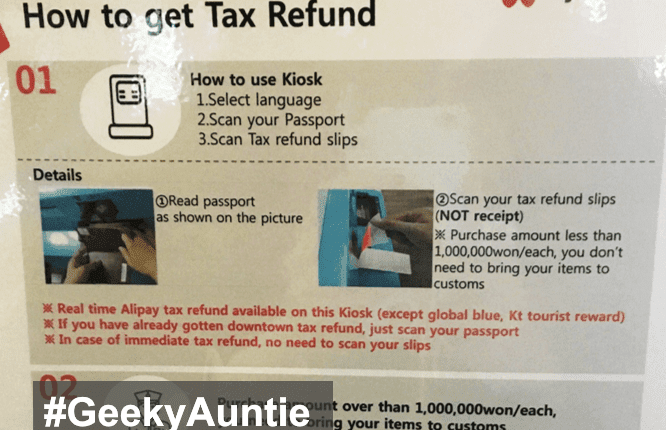

Step 3. Airport Customs Electronic Approval

After completing Downtown Tax Refund, the next step happens at the airport check-in hall. Simply scan your passport at the Tax Refund kiosks between Rows D & F or between Rows J & H to release the guarantee/deposit on your credit card and you are done!

Do I need to scan my receipts?

No, you do not scan your receipts. It’s the tax refund slips that’s relevant now.

Do I need to scan my tax refund slip?

If you have completed Downtown cash refund for that particular slip, then there is no need to scan it. For tax refund slips that have yet gone through Downtown cash refund, please scan them at this stage.

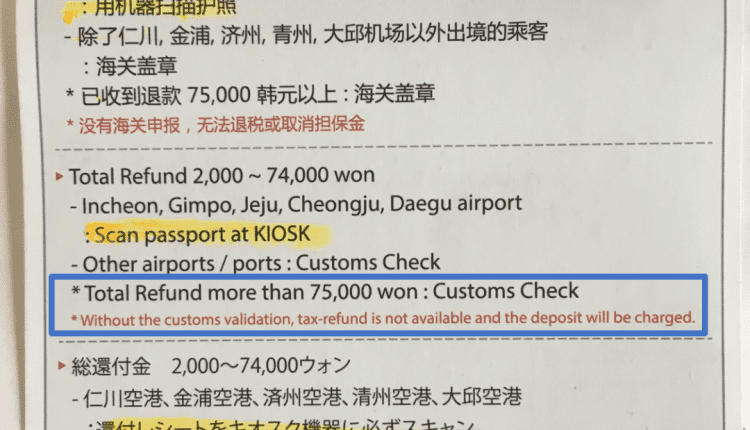

Do I need to show the Korea customs officers my shopping items?

For shopping items over KRW 1,000,000 or total refund amount exceeding KRW 75,000, yes, please show the shopping items to the customs officer. Otherwise, you probably can check-in your luggage beforehand. That’s what I did!

Do I check-in before heading for Korea customs electronic approval?

Yes, please check-in before heading for Customs Electronic Approval. If you have purchased above KRW 1,000,000 or have refund amounts exceeding KRW 75,000, please inform the check-in counter staff that you need your luggage for tax refund purposes and they will guide you from there.

Method 2: Korea Airport Tourist Cash Refund Procedure

If you would like to make an Airport cash refund claim, here’s how it goes.

Step 1. Ask Shop Cashiers for Tax Refund Slips

Same as step 1 of Downtown claim method stated above.

Ask for a tax refund slip at the cashier and you’ll be given one usual receipt and a tax refund slip in an envelope. The envelope specifies which company to claim from. A minimum spending of KRW 30,000 in a single receipt qualifies for tourist tax refund.

Do I need to fill in my personal details on the receipts and tax refund envelopes?

It is no longer necessary.

Step 2. Airport Customs Electronic Approval

Slightly different from step 3 of Downtown claim method stated above, as tourists will need to scan their tax refund slips at the kiosks.

Simply scan your passport and tax refund slips at the Tax Refund kiosks between Rows D & F or between Rows J & H to release the guarantee/deposit on your credit card.

Do I need to scan my tax refund slip?

If you have completed Downtown cash refund for that particular slip, then there is no need to scan it. For tax refund slips that have yet gone through Downtown cash refund, please scan them at this stage.

Do I need to show the Korea customs officers my shopping items?

For shopping items over KRW 1,000,000 or total refund amount exceeding KRW 75,000, yes, please show the shopping items to the customs officer.

Do I check-in before heading for Korea customs electronic approval?

Yes, please check-in before heading for Customs Electronic Approval. If you have purchased above KRW 1,000,000 or have refund amounts exceeding KRW 75,000, please inform the check-in counter staff that you need your luggage for tax refund purposes and they will guide you from there.

Step 3. Airport Cash Refund

The airport cash refund booths are located at Gate 27 – 28 in the transit hall. Please refer to the map provided earlier.

Additional Tips

1. A couple of the better money changers around MyeongDong charge a spread of around 1%, which is way better than ATM’s 2% and Credit Card’s 3%, so you know what to do.

2. Do your ground research by checking the rates with a few money changers to get the best deal. Also, money changers in MyeongDong probably offer much better rates than those in other areas due to the high competition.

Content provided here are based on the writer’s personal experience and is in no way a representation of any official Korean sources.

Comments are closed.